Container prices decline, other worries unabated

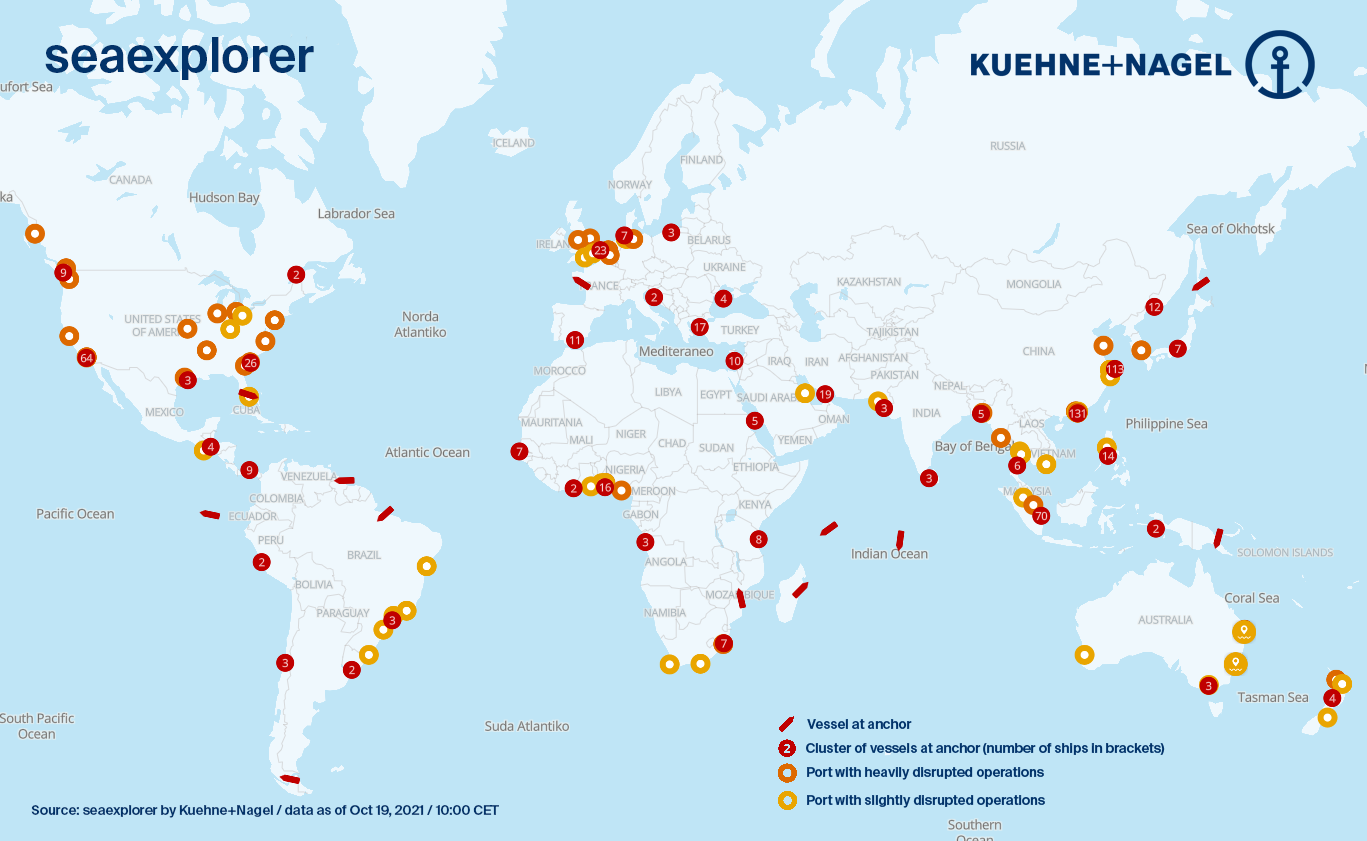

There are over 70 container ships around the US west coast and east coast, according to data from SeaExplorer, a shipping data insight platform of Kuehne+Nagel, one of the world's largest freight forwarders. Over 200 container ships are outside various ports across China.

October 19, 2021: Amidst the gloom of supply chain woes, congestion at the ports and worries about stores running out of gifts during the Christmas season, here's one reason for a small cheer: container prices are easing as China resumes activities post the Golden Week.

As many as 46 ports globally experienced a moderate pullback in average container prices, according to Container xChange, a marketplace for container leasing and trading.

The hotspots include China, Vietnam, and the United States. Price falls indicate improvement in congestion that caused skyrocketing freight costs all over the world, the exchange said.

"We are experiencing improvement in the market situation as the one-way leasing charges, spot rates and other freight costs are starting to stabilise and average standard container prices are witnessing a drop for the first time in many weeks," said Christian Roeloffs, founder and CEO, Container xChange. "Though we are still yet to see how the market responds further to inventory stocking by US importers in the coming months, these are good signs of the market correction. The drop in prices could also possibly be only a temporary decline because of the Golden Week in China if the prices do not decline further."

The average trading price of 40 feet high cube containers is down 22 percent from $8,516 to $6,598, the biggest decline witnessed this year in China. In Ningbo, for instance, average prices for 40 high cube containers peaked at $7,184 and have been falling every week since, and is now down to $6,803.

"The average one-way leasing pickup charges for the China-US stretch are down to $1,800 from $2,767, a 35% plunge, the highest recorded this year on this stretch. Similarly, these rates have also reduced for stretches ex-China to a few ports in Europe (Hungary, Netherlands, Slovakia) and the Russian Federation," according to a statement from Container xChange.

Meanwhile, it has been reported that over 200,000 containers are stuck off the coast of Los Angeles in a sign that the supply chain worries are not ending anytime soon.

There are over 70 container ships around the US west coast and east coast, according to data from Seaexplorer, a shipping data insight platform of Kuehne+Nagel, one of the world's largest freight forwarders. Over 200 container ships are outside various ports across China, Seaexplorer data show.

"Vessels are spending longer in port than usual to unload and depart due to a pile-up of containers in port, causing disruptions to liner schedules and further reducing vessel availability," according to VesselsValue, an online valuation and data provider for the shipping industry. Since the beginning of the month, 31 vessels have moved through Felixstowe, one of the U.K's major container ports equating to 281,408 TEUs. "This is 45% less than the same period in 2020, and 51% less than the same period in 2019, suggesting that the port is struggling with turnaround times."

Simon Heaney, senior manager, container research, Drewry, said in a presentation today that the average global freight rates (spot + contract) are likely to be higher by 126 percent in 2021.

"For 2022, strengthening contract rates will more than offset a softer spot market, resulting in an overall increase of about 6 percent," Heaney said.

Heaney added that carriers are not sitting on their profits (likely to be around $150 billion in 2021) and ordering more ships and containers (nearly $2 billion).

Despite rising costs, stronger freight rates and persistent supply chain bottlenecks should result in a similar result for carriers in 2022, Drewry said in its presentation.

Lars Jensen, a leading expert in the container shipping industry, said in his latest LinkedIn update that "the extremely high prices in container shipping is likely to force some shippers out of the market. And if we want a free market for shipping this is a perfectly normal consequence."

It is most likely that the container shipping markets will eventually normalise, Jensen wrote "but that normality apt to be somewhat different than what we came from, it is also unclear which timeframe we are looking at for a normalization."

Holiday rush is likely to push congestion at US ports, and no let-up is seen in demand during the holiday season.

Supply-chain bottlenecks are disrupting the global economic recovery and are getting worse, Moody's Analytics said in a report released last week.

"Every link of the chain is seeing problems, but the weakest link may be the shortage of truck drivers. Challenges include differences in pandemic policies around the world and lack of a concerted effort to smooth operation of the global logistics and transportation network," the report said.

Hamid R. Moghadam, chairman and CEO of warehouse giant Prologis Inc., said last week while announcing Q3 results that supply chain disruptions due to Covid-19 may be a temporary event but growth in e-commerce and increasing inventory levels could be permanent developments of the warehousing and logistics space.

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com