India remains 2nd on Agility Logistics Index; reduces gap with China

Many see India growing in importance as a producer and market but cite inadequate infrastructure and corruption as the biggest obstacles.

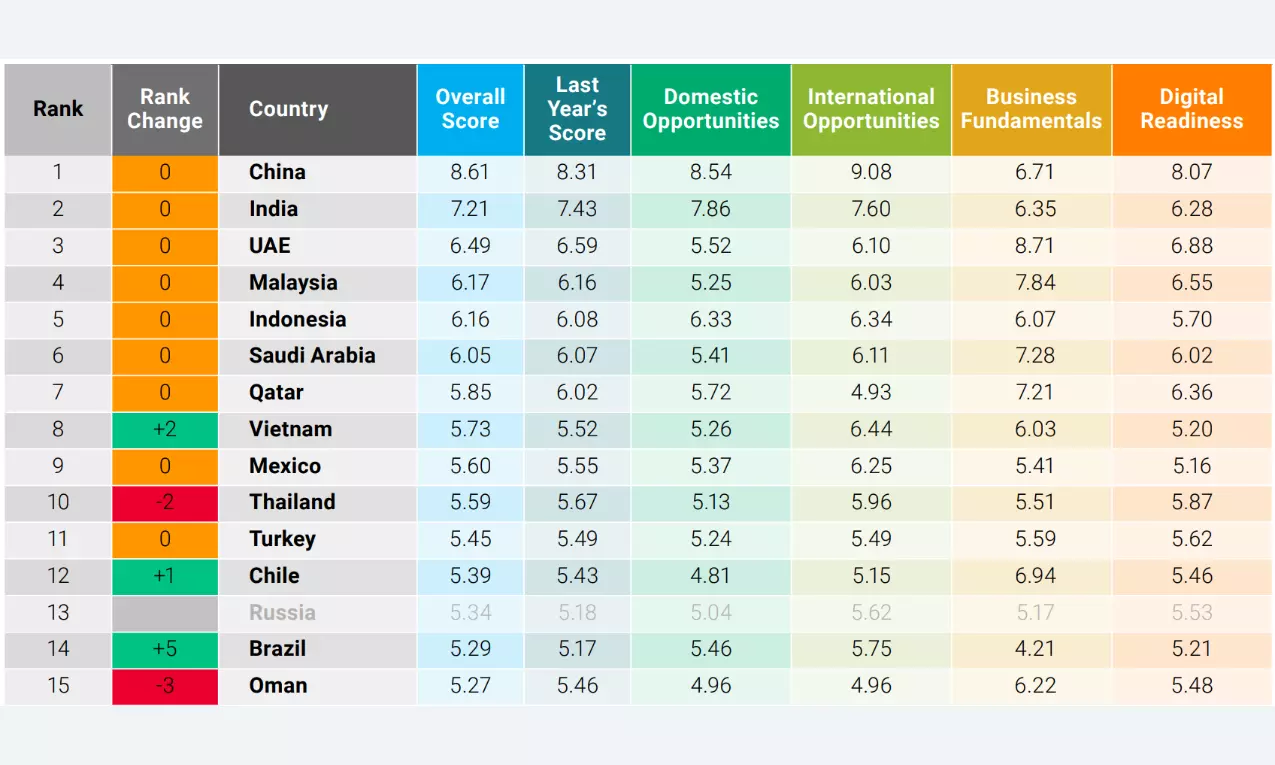

The Agility Emerging Markets Logistics Index – Overall Ranking

China remains at the top of the Agility Emerging Markets Logistics Index, however, compared to last year, fewer respondents selected it as the region with the strongest economic growth in the year ahead. China is closely followed by India as the region with the second strongest economic growth, making the gap between these two regions much smaller compared to previous years.

China and India, the world’s two largest countries, held their spots at No. 1 and 2 in the overall rankings. UAE, Malaysia, Indonesia, Saudi Arabia, Qatar, Vietnam, Mexico, and Thailand rounded out the top 10. No. 24 South Africa and 25 Kenya were highest among countries in Sub-Saharan Africa.

Three of the four countries offering the best emerging markets business conditions are situated in the Arabian Gulf: UAE (1), Saudi Arabia (3) and Qatar (4). Malaysia (2) and Jordan (5) both moved up in the business fundamentals rankings.

China and India were tops for domestic and international logistics. In digital readiness, China jumped three spots to No. 1, followed by UAE, Malaysia and Qatar. India fell from the top spot a year ago to No. 5 this year.

Global logistics executives, still worried about recession, say they are battling higher costs, reducing dependence on sourcing from China, and planning to boost investment in Africa despite seeing emerging markets investment overall as somewhat riskier in a survey which is part of the index.

The survey and Index are Agility’s 15th annual snapshot of industry sentiment and ranking of the world’s 50 leading emerging markets. The Index ranks countries for overall competitiveness based on their logistics strengths, business climates and digital readiness — factors that make them attractive to logistics providers, freight forwarders, air and ocean carriers, distributors and investors.

Half of the 830 industry professionals surveyed for the 2024 Agility Emerging Markets Logistics Index expect a global recession in the coming year – down from nearly 70% a year ago.

More than 63% of respondents say their companies continue overhauling supply chains by spreading production to multiple locations or relocating it to home markets and nearby countries. China, the world’s leading producer, stands to be most affected: 37.4% of industry professionals say they plan move production/sourcing out of China or reduce investment there.

“Shippers and carriers are struggling to minimize supply chain risk and find new growth opportunities. Inflation and recession risks have eased, but the industry is still living with the aftershocks of the COVID pandemic. At the same time, businesses are worried about geopolitics — troubled trade relations between China and the U.S. and Europe, and the thicket of sanctions against a growing number of countries,” says Agility vice chairman Tarek Sultan.

Shipping and logistics costs that soared during the COVID pandemic and its aftermath are still climbing but at a slower rate, the survey found. One way shippers expect to cope is by increasing use of digital freight forwarding from 37.8% today to 52% in five years.

Meantime, the industry is gearing up for a surge in Africa investment. Nearly 62% of professionals say their companies are planning additional or first-time investments in Africa vs. only about 7% exiting or scaling back there.

Outside of the top 10, many of the biggest swings in year-to-year rankings involved countries experiencing conflict, facing international economic sanctions, or suffering from chronic economic instability. Among them: Ukraine, Russia, Iran, Ethiopia, Argentina, Lebanon, Tunisia.

2024 Index Highlights

Survey

Supply chain restructuring – India, Europe and North America rank ahead of China as destinations executives expect to move production to in 2024 and onwards.

China – 40% expect their businesses to be less reliant on China in five years. Leading factors in decisions to de-risk in China: difficulty of doing business; U.S.-China trade friction; a slowing economy; the harshness of China’s COVID restrictions.

Climate change – 66% say climate change is something they’re planning for, or already affecting their businesses.

Emerging markets – the largest percentage sees increased risk/decreased rewards in emerging markets.

India – many see India growing in importance as a producer and market, but cite inadequate infrastructure and corruption as the biggest obstacles there.

Country Rankings

In the Middle East and North Africa, overall rankings were: UAE (3); Saudi Arabia (6); Qatar (7); Turkey (11); Oman (15); Bahrain (16); Jordan (17); Egypt (20); Kuwait (21); Morocco (22); Tunisia (37); Lebanon (38); Iran (40); Algeria (42); Libya (50).

Rankings in Sub-Saharan Africa: South Africa (24); Kenya (25); Ghana (31); Nigeria (36); Tanzania (41); Uganda (43); Ethiopia (45); Mozambique (46); Angola (47).

Index rankings in Asia: China (1); India (2); Malaysia (4); Indonesia (5); Vietnam (8); Thailand (10); Philippines (18); Kazakhstan (23); Sri Lanka (26); Pakistan (29); Cambodia (32); Bangladesh (33); Myanmar (49).

Rankings for Latin America: Mexico (9); Chile (12); Brazil (14); Uruguay (19); Peru (28); Colombia (27); Argentina (30); Ecuador (35); Paraguay (39); Bolivia (44); Venezuela (48).

In Europe: Russia (13); Ukraine (34).

Transport Intelligence (Ti) has compiled the Index since it was launched in 2009.

John Manners-Bell, Chief Executive of Ti, said: “Supply chain managers are still coming to terms with the political and economic instability characterising the post-COVID global economy. Geopolitical relationships are changing rapidly, and this is having a major impact on international trade and risk profiles. Businesses need to be alive to the opportunities and threats that exist in emerging markets and use data, such as that the Agility Emerging Market Logistics Index, to inform agile decision-making.”