Container turnaround time accelerates in Asia but congestion in US/Europe ports delay supply chain recovery

Containers are moving in and out of China at record speeds as shippers desperately source capacity but port congestion in Europe and the US continues to slow the return of boxes to Asia and is hurting the recovery of the global ocean supply chain.

January 11, 2022: Containers are moving in and out of China at record speeds as shippers desperately source capacity but port congestion in Europe and the US continues to slow the return of boxes to Asia and is hurting the recovery of the global ocean supply chain.

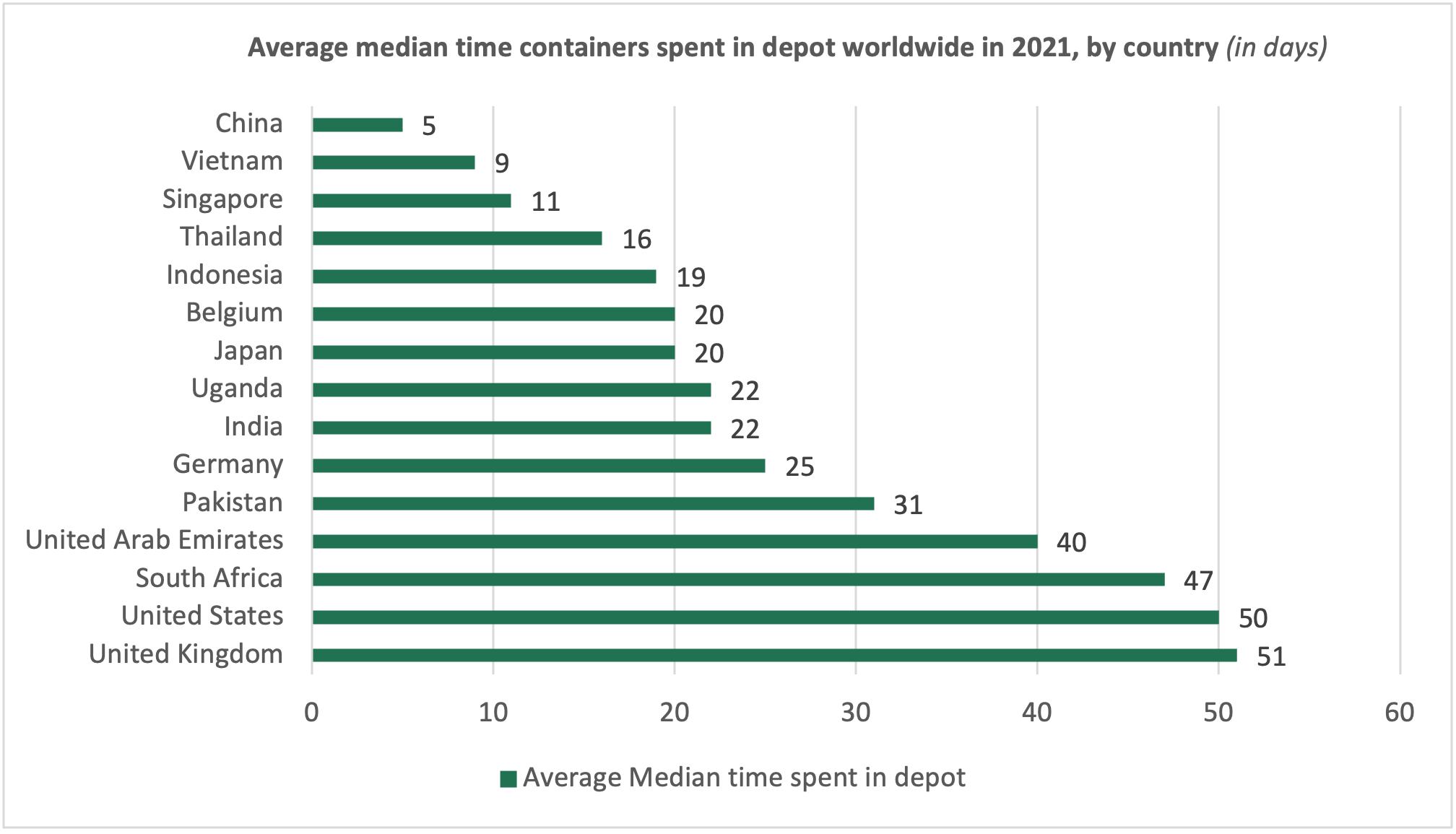

The average median time containers spent in Chinese depots dropped to just five days, down from 61 days in 2020, according to a joint report by Container xChange and applied research organisation Fraunhofer–CML.

"China was not alone among leading exporters in seeing rapid box turnarounds last year. Vietnam, Singapore, Thailand and Indonesia recorded average median times that containers spent in depots of nine, 11, 16 and 19 days, respectively."

(Source: Container xChange)

Dr. Johannes Schlingmeier, co-founder and CEO, Container xChange, says: “Once containers reach Asia, they are being redeployed at record speeds. However, the mismatch between supply and demand at many origin ports, including China, means it is hard for US and European importers to always secure boxes unless they have planned ahead or are working closely with their box supplier, forwarder or container line to ensure they have both a vessel slot and a container available in advance.”

The worst performing countries in terms of the average median time containers spent in depots in 2021 were the U.S. and the U.K which suffered average dwell times of 50 and 51 days, respectively.

The next worst performers were South Africa (47 days), United Arab Emirates (40 days), Pakistan (31 days) and Germany (25 days).

Freight rates continue to be high

Container shipping-rate assessments for North Asia-to-North America routes held steady in the first week of 2022 to January 7 as General Rates Increases (GRIs) implemented by some shipping lines w.e.f January 1 matched those from other carriers in late December, S&P Global Platts said in its latest update.

"Momentum in the spot market remained firmly to the upside amid strong demand in the run-up to Lunar New Year in East Asia beginning Feb. 1, with rate reductions thereafter appearing unlikely as widespread cancellations of trans-Pacific sailings are expected to leave a huge backlog of cargo to loaded in the months ahead."

North Asia-to-West Coast North America rates were flat at an all-time high of $9,500/FEU while North Asia-to-East Coast North America rates also held record levels at $10,900/FEU, the update added.

Most trans-Pacific eastbound bookings also included premium services fees of $5,000-$10,000/FEU or even up to $15,000/FEU for the most urgent bookings of around 50 containers at a time.

No letup in congestion across LA/LB ports

Total container ship backup across Los Angeles/Long Beach ports continued to be 102 on Monday January 10, 2022 - three fewer than last Friday, according to data from Captain J. Kipling (Kip) Louttit, Executive Director, Marine Exchange of Southern California & Vessel Traffic Service Los Angeles and Long Beach San Pedro, CA.

"The 102 total container ships backed up includes 14 container ships at anchor or loitering inside 40 miles from the ports of LA and LB plus 88 slow speed steaming or loitering outside the Safety and Air Quality Area (SAQA)."

The new queuing process for container vessels has now been expanded to the Port of Oakland following success at LA/LB ports.

"Container vessels will receive an assignment in the arrival queue based on their departure time from their last port of call, and wait outside a new Safety and Air Quality Area 50 miles off the Northern California coast until their appointed arrival time. The previous system placed container vessels into the arrival queue based on when they crossed a line 80 nautical miles from the coast," says a statement from Pacific Merchant Shipping Association.

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com