Supply chain woes may ease but Omicron could pose risks

Supply chain bottlenecks are set to ease but from strained levels in the first quarter of 2022 and recede gradually as the supply of goods improves, consumer demand shifts and labour markets evolve, Moody's Investors Service said in a report.

December 10, 2021: Supply chain bottlenecks are set to ease but from strained levels in the first quarter of 2022 and recede gradually as the supply of goods improves, consumer demand shifts and labour markets evolve, Moody's Investors Service said in a report.

Other findings include:

- Discovery of the new Omicron variant could cause the snarls to persist for longer than Moody's expects, which would pose risks to the global growth and inflation outlook.

- Overall global manufacturing and trade activity remain strong and labour markets are still improving; and

- Taiwan's electronic component exports - often considered a proxy for semiconductor shipments - continued to increase in November.

"Our global growth and inflation forecasts assume that demand for goods will moderate in 2022 as consumers shift toward consumption of services. But spread of the new virus variant, depending on its transmissibility and virulence, could still slow services demand and lead to new supply disruptions," the report said.

Semiconductor production has been a closely watched indicator of the demand-supply stresses in the global economy, the report said. "Taiwan’s electronic component exports, often considered a proxy for semiconductor shipments, continued to increase in November. Auto production in Germany and the U.S, which has been hamstrung by semiconductor shortages, picked up slightly in October, which suggests that semiconductor shortages in the auto industry may no longer be worsening and may be easing. However, the extended chip shortage – as well as a shortage of magnesium – has led the order backlog for Germany's motor vehicles to spiral and improvement will take several months."

Recent data indicate that freight rates for transporting goods to the U.S and Europe have generally stabilised with prices slightly lower in early December than the peak in October."We expect shipping congestion to start to improve after the peak demand season around Christmas and through 2022. Still, the increasing complexity of the supply chain will continue to complicate the economic recovery path. Shipping pressures will likely ease only slowly given the need for replenishing inventory stocks, strong housing activity, investment and production activity as the economic expansion strengthens. Additional COVID-19 outbreaks and extreme weather events could cause disruptions to persist for longer."

Blank sailings crunch space; freight rates move up

Space crunch is expected on TPEB (Asia-North America) through the end of 2021 and into early 2022 as carriers continue to announce additional blank sailings, Flexport said in its latest update.

"Congestion-related delays, sliding schedules, early closure of feeder port operations, and Covid-related restrictions are all at play in reducing available capacity. Blank sailings to the PSW in particular are severe."

Rate levels remain elevated due to strong pre-Lunar New Year demand, and the premium market also remains strong. "Continue to book well in advance (at least 4 - 6 weeks) prior to targeted departure for best possible chance of hitting target departure date. Encourage suppliers to be flexible and support departures from different origin ports."

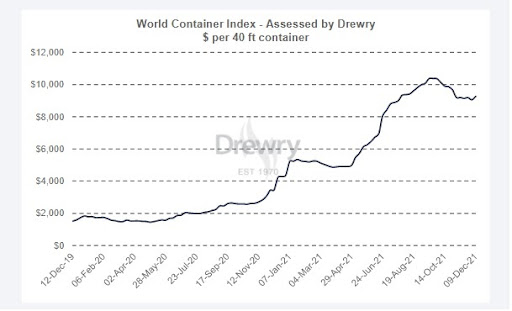

Drewry’s composite World Container index increased 2.3 percent to $9,262.02/40ft container this week and remains 170% higher than a year ago.

Freight rates on Shanghai–Los Angeles surged 5 percent to $10,138/40ft box. Spot rates on the Shanghai–New York and Shanghai–Genoa routes increased 4 percent and 3 percent to $13,118 and $12,801/FEU, respectively.

"Rates on Shanghai–Rotterdam, Los Angeles–Shanghai and New York–Rotterdam hovered around previous weeks level. Drewry expects rates to remain steady in the coming week."