India sees tighter air cargo capacity as Asia-Pacific peak builds

Holiday demand, fog and hub congestion pressure India’s exports as Asia-Pacific air freight stays strong.

India’s air freight market is facing tight capacity in December as strong export volumes, winter fog in North India and rising regional demand add pressure on Asia-Pacific air cargo networks. The wider region continues to see firm peak-season activity, lifted by growing e-commerce flows to the United States, increased intra-Asia movement of raw materials and heavy demand at major transit hubs.

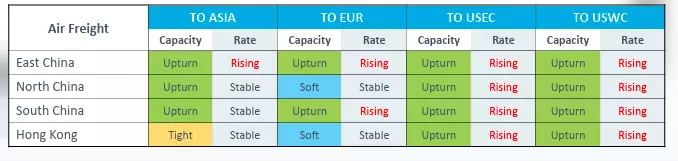

Dimerco’s December Asia Pacific Freight Report shows that Indian export activity remains strong across electronics, garments and e-commerce. Most US-bound cargo is moving through Europe, which limits available space from India. The report notes that restricted belly space and very few new freighters add further strain, while fog and hub congestion may slow operations at key Indian airports.

Across the region, transpacific air demand has risen sharply since mid-November, driven by Black Friday and Thanksgiving promotions. High volumes from Southeast Asia continue to fill hubs such as Taipei, Hong Kong, Incheon, Narita and Singapore. Demand on China–Mexico lanes is also increasing as shippers push cargo ahead of possible tariff actions. These flows contribute to tight capacity on several intra-Asia sectors that link with India.

The report highlights steady activity between China, Singapore, Thailand, Vietnam and Malaysia as raw materials move within the region to support production. Airlines indicate that 2026 BSA rates may stay close to current levels even though many expect a softer market next year.

In markets linked to India, the Philippines, Malaysia, Thailand, Singapore, Indonesia and Vietnam are all experiencing tight or rising air cargo rates, especially to the US and Europe. Singapore and Manila report very limited space heading into the holiday period, while Vietnam expects constraints before Christmas and New Year. These conditions influence the availability of connections for Indian exporters depending on regional transit points.

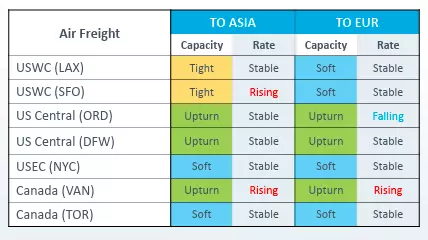

North American demand patterns also play a role. Capacity from major US gateways to Asia is tightening because of high-tech export volumes, and congestion at some terminals adds to delays. Canada reports no major air capacity issues, although fewer direct flights to Asia are available.

Weather-related disruptions continue to affect Asia more broadly. Typhoon damage in China earlier in the season caused delays and schedule changes, pushing some carriers to shift capacity from short-haul to long-haul services. This move tightened space on Southeast Asia routes, including those used by Indian shippers.

The report also warns that the grounding of MD-11F aircraft after a crash has reduced global long-haul freighter capacity, especially on e-commerce lanes. This reduction may lift rates further through December and require shippers in India and the region to plan flexible routings.

As the peak period continues, Indian exporters may need to secure space earlier, adjust routings through alternative hubs or prepare for longer transit times. With demand still firm and capacity challenges appearing across neighbouring markets, the pressure on India’s air freight flows is likely to remain through the end of the month.