Asia-Pacific freight tightens before Lunar New Year, says Dimerco

Report highlights cautious demand, heavy use of blank sailings, slowing e-commerce, and a sharp risk of volatility after factory shutdowns.

Freight markets across the Asia-Pacific region are tightening ahead of the Lunar New Year, as seasonal front-loading activity puts pressure on both air and ocean capacity, while underlying demand on major trade lanes to the US and Europe remains cautious, according to Dimerco’s February 2026 Asia-Pacific Freight Report.

The report said short-term freight demand across Asia is being supported mainly by pre-holiday shipping, even as broader economic signals remain weak. Global manufacturing ended 2025 with only marginal expansion, with the Global Manufacturing PMI hovering around 50.5, indicating subdued order growth and cautious demand heading into the first quarter of 2026.

In the air freight market, demand from Asia to the US and Europe is easing as February begins, with only a modest pre–Lunar New Year uplift expected. E-commerce volumes have continued to slow since January, keeping spot air freight rates on long-haul transpacific and Asia–Europe routes largely stable or under mild downward pressure. Despite softer demand on these lanes, intra-Asia air freight markets are facing tightening capacity as shippers rush to move cargo ahead of factory closures.

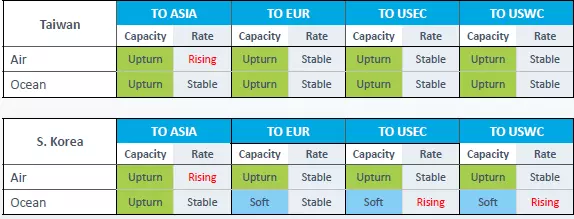

In Northeast Asia, short-term air cargo demand is being supported mainly by high-tech shipments. However, the report said this support is driven by calendar pressure rather than structural demand recovery. In Taiwan, tight air cargo capacity has led airlines to announce rate increases on certain regional routes, while demand remains strong on services to Southeast Asia. Direct air freight services from Taiwan to the US remain stable, although capacity on regional Asian routes is constrained.

South Korea’s air freight market shows mixed conditions. Export volumes to the US have slowed, and space availability remains generally sufficient. However, capacity is tightening on regional Asian routes due to reduced flight frequencies by key carriers and increased high-tech shipments. This is keeping space constrained on services to destinations such as Singapore, Penang, Kuala Lumpur and Taipei.

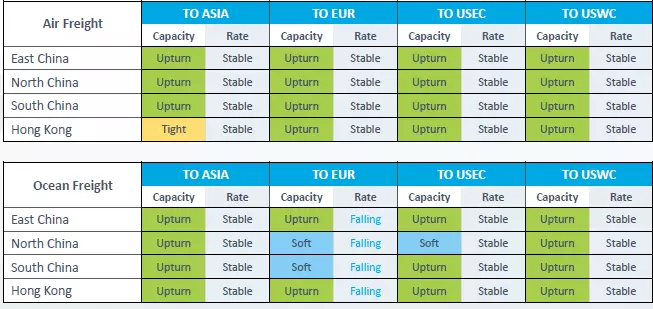

In China, both air and ocean freight markets are heavily influenced by the approaching Lunar New Year. In North China, air freight capacity and rates are stable, with a brief pre-holiday demand bump expected to tighten space temporarily. In East China, higher demand in early February is expected to push air freight rates up across multiple lanes, although the report warned that rates are likely to fall sharply during and after the holiday. Capacity is tight on air routes to Singapore and Taipei, while some direct services to Penang are facing operational delays. In South China and Hong Kong, air freight demand is rising ahead of the holiday due to early e-commerce stockpiling, followed by an expected sharp drop once factory shutdowns begin. Airlines may respond to weaker post-holiday demand by cancelling flights in February.

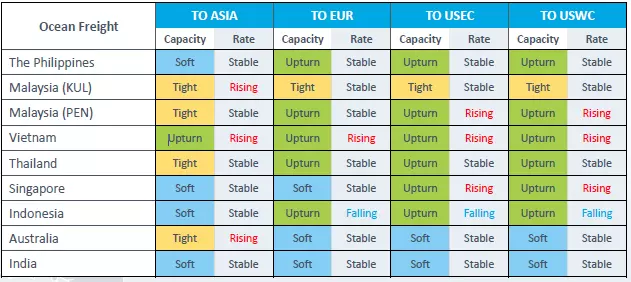

Across Southeast Asia, freight markets are tightening across both air and ocean modes ahead of the holiday. In Malaysia, export activity is elevated, tightening capacity and adding pressure due to congestion at Port Klang. In air freight, space is tightening and rates are rising on key long-haul routes. Vietnam is seeing strong pre-holiday demand across both air and ocean freight, leading to tighter capacity and higher rates, particularly on US-bound lanes. Thailand’s freight market is also tightening, with air freight capacity under pressure due to rising regional demand and ocean shipments facing potential delays linked to pre-holiday congestion at Chinese ports.

In Singapore, air freight capacity is expected to tighten further as some airlines cancel flights during the Lunar New Year period. On the ocean side, carriers may blank sailings on certain routes, creating additional space constraints. The Philippines is experiencing a pre-holiday rush in both air and ocean freight, with higher rates and tighter capacity expected before a post-holiday slowdown. Indonesia’s freight market remains more balanced, with relatively stable air and ocean conditions compared with neighbouring markets.

In India, air freight demand is easing as the market normalises after the peak season. Carriers are optimising schedules following the fourth quarter, which is expected to improve space availability on long-haul routes. Improved winter weather conditions are supporting smoother air cargo operations as fog-related disruptions ease. However, airspace constraints linked to the Iranian region continue to affect routings to the US, Europe and CIS markets, leading to longer transit times and potential delays. On the ocean side, carriers are planning to apply general rate increases on shipments to the US East and West Coasts in February, which could push rates higher if implemented.

In Australia, early factory closures are prompting shippers to move cargo ahead of the Lunar New Year. This is tightening both air and ocean capacity and increasing the risk of higher rates and rollovers during the holiday period.

On the ocean freight side more broadly, the report said carriers are continuing to defend rate floors on transpacific routes despite soft cargo demand. Pricing discipline is being maintained through capacity control rather than strong demand. Nearly half of all global blank sailings are concentrated on the Transpacific Eastbound trade lane, highlighting cautious expectations among carriers. While the Lunar New Year could provide temporary rate support, cargo volumes have yet to show a clear pre-holiday surge, leaving the market vulnerable to sharp swings once factories close and inventory digestion begins.

Dimerco said the current freight environment is defined by a narrow and compressed planning window. Capacity is tightening quickly ahead of the Lunar New Year across both air and ocean markets, while demand remains uneven across regions. Once factory shutdowns begin and shipping activity slows, the report expects renewed volatility as capacity returns unevenly and demand conditions remain fragile.