Schedule reliability plunges to 35.8% in 2021; 14% sailings cancelled

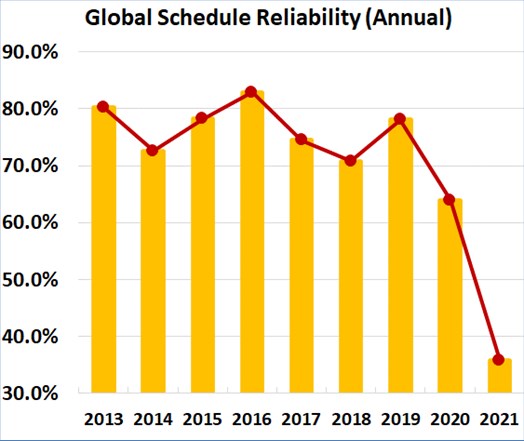

The schedule reliability of global carriers dropped from 78 percent in 2019 to 63.9 percent in 2020 and then to 35.8 percent in 2021 - the lowest recorded schedule reliability and a staggering drop from the pre‑2020 levels.

February 8, 2022: The schedule reliability of global carriers dropped from 78 percent in 2019 to 63.9 percent in 2020 and then to 35.8 percent in 2021 - the lowest recorded schedule reliability and a staggering drop from the pre‑2020 levels.

(Credit: Sea-Intelligence)

The average delay for LATE vessel arrivals has been on an upwards trend since the lowest recorded delay of 3.19 days in 2016. "In 2021, the figure nearly touched the 7‑day mark, reaching 6.86 days. The average delay for ALL vessel arrivals recorded a sharp increase in 2020, and an even sharper increase in 2021 with the 2021 figure crossing the 4‑day mark for the first time," says Alan Murphy, CEO, Sea-Intelligence.

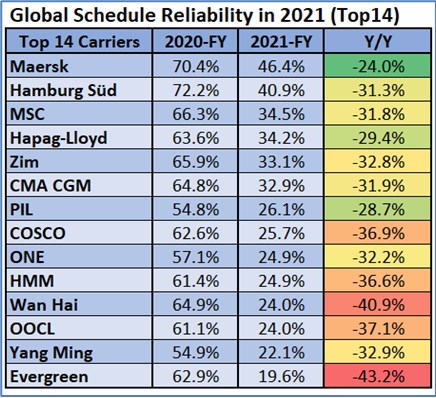

Maersk was the most reliable top‑14 carrier in 2021 with schedule reliability of 46.4 percent, followed by Hamburg Süd (40.9%).

(Credit: Sea-Intelligence)

"Four carriers recorded schedule reliability of 30‑40 percent, and seven carriers recorded schedule reliability of 20‑30 percent."

All six major East/West trade lanes recorded double-digit declines annually in schedule reliability with the Asia‑Europe and Asia-North America West Coast trade lanes recording Y/Y declines of over 40 percentage points.

Cancelled sailings at 14%

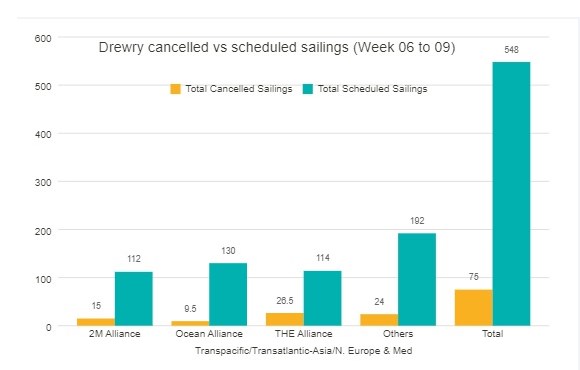

Across the major trades: Transpacific, Transatlantic and Asia-North Europe & Med, 75 cancelled sailings have been announced between weeks 06 and 09 out of a total of 548 scheduled sailings, representing 14% cancellation rate.

"During this period, 72 percent of the blank sailings will be occurring in the Transpacific Eastbound trade, and mostly to the West Coast," according to the latest Cancelled Sailings Tracker from Drewry.

Over the next four weeks, The Alliance has announced 26.5 cancellations, followed by 2M and Ocean Alliance with 15 and 9.5 cancellations, respectively.

Freight rates steady

Trans-Pacific Freight All Kinds rates into North America were largely steady during last week, S&P Global Platts said in its weekly update.

"Despite a general stabilisation of rates in the North American market, there was a small upside of $50 to $10,950/FEU for trans-Pacific bookings into the USEC as more shippers looked to all-water strings servicing the Atlantic Coast amid ongoing delays on the US Pacific coast."

North Asia-to-West Coast North America was range bound during the week at $9,500/FEU.

Europe-to-East Coast North America was at $7,500/FEU on February 4, a record high. "Sources say tight capacity, mixed with firm demand, propelled rates to new heights, with little expectations for short-term easing."

With the Lunar New Year finally taking place, the Asia to Europe container freight market breathed a sigh of relief with the picture of what is to come starting to appear clearer in some market participant's minds, the report added.

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com