Rebounding export orders to help improve air cargo in 2-3 months: IATA

September 1, 2020: In its July 2020 Air Cargo Market Analysis, International Air Transport Association (IATA) noted that the new export orders, a leading indicator for air cargo and component of the global manufacturing PMI, rebounded to a 2.8 percent decline in July, up from 45 percent in April, and is expecting to have a similar effect on air car

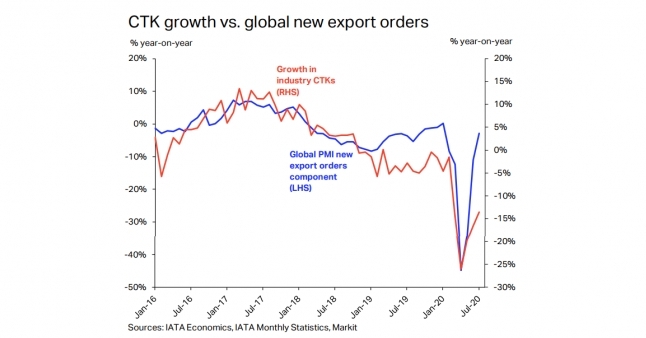

September 1, 2020: In its July 2020 Air Cargo Market Analysis, International Air Transport Association (IATA) noted that the new export orders, a leading indicator for air cargo and component of the global manufacturing PMI, rebounded to a 2.8 percent decline in July, up from 45 percent in April, and is expecting to have a similar effect on air cargo in next 2-3 months.

Despite growing uncertainty in Covid-19 developments, economic activity continued to recover in July with indicators such as manufacturing output and new export orders are improving. Economic activity has been able to restart, with retail sales and industrial production showing robust recoveries in many key countries.

“Economic activity continued to recover in July reflected in the performance of the Purchasing Managers’ Index (PMI), an indicator of economic health in the manufacturing sector. The global PMI returned above the 50-line consistent with month-on-month growth in output and GDP. Output also rose in many key exporting economies, such as China, the US and Germany. Historically, growth in this PMI has been a reliable leading, or at least coincident, an indicator of growth in industry-wide cargo tonne-kilometres (CTKs),” said the analysis.

Alexandre de Juniac, director general & CEO, IATA, said, “Economic indicators are improving, but we have not yet seen that fully reflected in growing air cargo shipments. That said, air cargo is much stronger than the passenger side of the business. And one of our biggest challenges remains accommodating demand with severely reduced capacity. If borders remain closed, travel curtailed and passenger fleets grounded, the ability of air cargo to keep the global economy moving will be challenged.”

Global #aircargo demand in July was 13.5% compared to 2019 & available capacity 31.2%

— IATA (@IATA) August 31, 2020

Economic activity is increasing but with reduced capacity due to grounded pax fleets the ability of #aircargo to keep the global economy moving is compromised. https://t.co/KkHc2l9lhj pic.twitter.com/jJaewwzx3W

Air cargo in July

IATA released data for global air freight markets in July showing Industry-wide CTKs declined by 13.5 percent year-on-year, while CTKs grew 2.6 percent month-on-month, similar to the pace of improvement seen in June (3 percent).

While there is some month-to-month improvement, it is at a slower pace than some of the traditional leading indicators would suggest. This is due to the capacity constraint from the loss of available belly cargo space as passenger aircraft remain parked.

Global capacity, measured in available cargo tonne-kilometres (ACTKs), shrank by 31.2 percent in July ( 32.9 percent for international operations) compared to the previous year. This is a small improvement from the 33.4 percent year-on-year drop in June.

Region wise air-cargo demand

Asia-Pacific airlines saw demand for international air cargo fall by 15.3 percent in July 2020 compared to the same period a year earlier. After a robust initial recovery in May, month-on-month growth seasonally-adjusted demand has softened. International capacity decreased by 32.0 percent.

North American carriers reported a single-digit fall in international cargo demand of 5.4 percent year-on-year in July. The stronger performance is due in part to strong demand on the transpacific, Asia-North America route, reflecting e-commerce demand for products manufactured in Asia. International capacity decreased by 30.9 percent.

European carriers reported a 22.4 percent annual drop in international cargo volumes in July. This was a slight improvement from June’s performance of -27.6 percent. Demand on most key trade lanes to/from the region remained weak. The large Europe–Asia market was down 20 percent year-on-year in July. International capacity decreased by 37.4 percent.

Middle Eastern carriers reported a decline of 14.9 percent in year-on-year international cargo volumes in July, an improvement from the 19 percent fall in June. Seasonally-adjusted demand grew 7.2 percent month-on-month in July–the strongest of all regions. This recovery was driven by the aggressive operational strategies of some of the region’s carriers. International capacity decreased 27.1 percent, the most resilient of all regions.

Latin American carriers posted a 32.1 percent drop in year-on-year international demand in July, down from a 28.6 percent decline in June. International capacity decreased by 44.5 percent. The drop in both demand and capacity was the most severe of all regions. The COVID-19 crisis is particularly challenging at present for airlines based in Latin America owing to strict lock-down measures. In July the Latin American air cargo market was smaller than the African market for the first time since these statistics have been reported in 1990.

African airlines posted a contraction of 3.0 percent in July. This was down from a 3.8 percent increase in demand in June. The small Africa-Asia market continued to support the region’s performance. International capacity decreased by 33.7 percent.