Global supply chains brace for peak-season pressure amid tariff volatility and capacity shifts

This year, demand growth is more focused on Southeast Asia, particularly Thailand, Vietnam, Malaysia, and Singapore.

Global supply chains are navigating a complex peak season as volatile tariffs, shifting demand, and capacity constraints disrupt shipping across major trade lanes. Southeast Asia, driven by high-tech and semiconductor exports, along with key hubs in China, Hong Kong, and India, is experiencing particularly tight air and ocean freight capacity, according to Dimerco’s latest Asia-Pacific Freight Market Report.

“September to November is always the peak season for air freight. This year, demand growth is more focused on Southeast Asia, particularly Thailand, Vietnam, Malaysia, and Singapore. With high-tech, AI, and semiconductor production increasing in these countries, more finished goods are being shipped out. As a result, we expect capacity pressure at major transit hubs including Singapore, Taiwan, Hong Kong, and Korea,” said Kathy Liu, Vice President of Global Sales and Marketing at Dimerco Express Group.

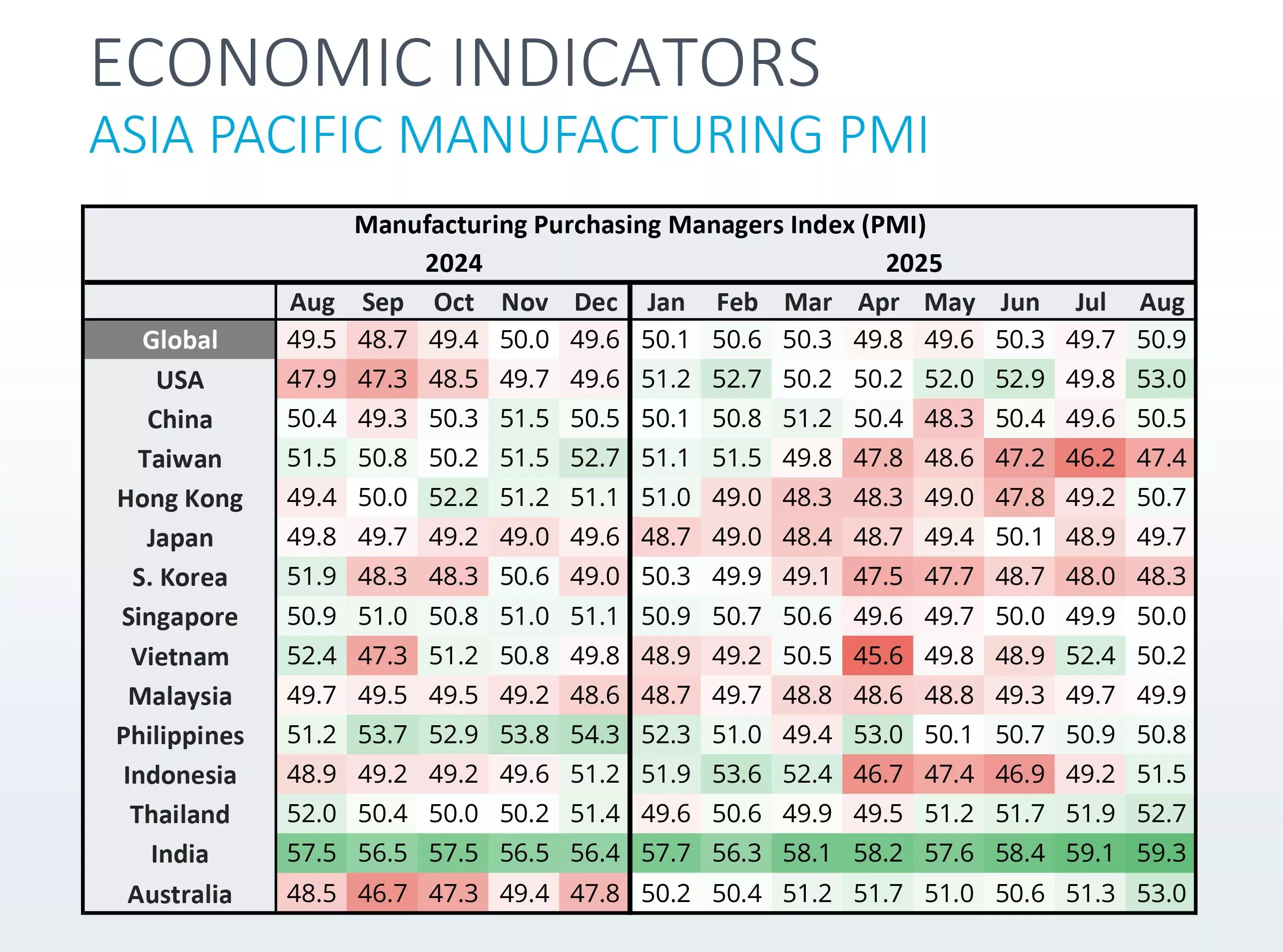

While global manufacturing output shows signs of resilience — with the composite PMI reaching a 14-month high of 52.9 — geopolitical uncertainty, tariff escalations, and protectionist trade policies are reshaping logistics strategies worldwide. India’s PMI surged to 59.3, the highest in Asia, while Taiwan (47.4) and South Korea (48.3) showed contraction.

The report notes that “broader tariff barriers are pressuring manufacturing worldwide, pushing companies to adjust sourcing and supply chains. Even so, global activity strengthened in August with the Composite PMI at a 14-month high of 52.9, though business confidence fell to its lowest amid geopolitical uncertainty and US protectionism, signalling risks to future shipping demand.”

Ocean freight

Trans-Pacific trade lanes are under particular strain as higher demurrage costs and falling order volumes force shippers to reassess sourcing and routing decisions. Spot rates continue to fall despite carriers aggressively cutting capacity. Carriers have increased blank sailings by 60% since late September, yet Shanghai–North Europe spot rates are down 45% over the past 10 weeks. Meanwhile, new vessel orders, now accounting for 30% of the global fleet pipeline, raise concerns over long-term overcapacity and sustained pricing pressure.

“At the same time,” reads the report, “major carriers’ operating margins have fallen to their lowest in 18 months, with some expected to post EBIT losses in Q4, highlighting ongoing cost pressures and weak freight rates.”

In Northeast Asia, ocean freight demand is soft, with US imports down due to trade policies and high inventories, while Europe remains flat amid weak consumer spending.

Southeast Asia shows a mixed picture: Thailand and the Philippines report stable to rising rates as export activity picks up around local and Chinese holidays, whereas Vietnam and Singapore maintain steady rates with moderate capacity.

India and Australia have sufficient vessel capacity, though India sees some softness on US and EU lanes.

In North America, West Coast ports experience tight but stable capacity, while central and East Coast routes face softer demand, with some cargo rolled due to limited vessels.

Europe’s trans-Atlantic westbound trade remains subdued, with spot rates and long-term contracts under downward pressure despite positive US economic indicators.

Air freight networks are also under stress.

Air freight

Global air freight is navigating a complex mix of regional demand surges, capacity constraints, and disruption risks, as per the report.

In Northeast Asia, strong electronics, AI, and semiconductor shipments from Taiwan and South Korea are driving stable to tight capacity, particularly on long-haul routes to the US and Southeast Asia, while South China and Hong Kong are facing temporary backlogs due to Super Typhoon Ragasa.

“Air freight capacity from China to Europe remains tight due to the ongoing China–Europe Railway disruption and the upcoming Golden Week. With the rail services being restored on September 25, constraints are still expected to last throughout October.”

“Super Typhoon Ragasa struck the Pearl River Delta and Hong Kong on September 23–24, causing widespread flight cancellations in South China and Hong Kong. Backlogs at Hong Kong, a key transit hub, are unlikely to clear before mid-October.”

Southeast Asia sees peak-season pressure focused on Thailand, Vietnam, Malaysia, Singapore, and the Philippines, where high-tech exports and festive-season cargo are tightening space and elevating rates.

India’s Diwali season adds further volatility, with selective air routes to the US and EU experiencing tight capacity.

Airfreight from the US West Coast to India “remains very tight, with passenger belly space unable to keep pace with growing manufacturing demand.”

Across North America and Mexico, capacity is increasingly tight on routes to Asia, reflecting strong manufacturing demand, seafood exports, and perishable shipments, although new aircraft and hub expansions in Mexico are easing some pressure.

Europe faces emerging risks from geopolitical unrest, including drone activity in Poland and the Baltics, which could exacerbate delays and push rates higher, especially on trans-Asia and intra-European lanes.

While air freight volumes are elevated due to peak season and high-tech demand, supply remains stretched in key hubs, making proactive planning, early bookings, and alternative routing essential for shippers.

The report also highlights growing geopolitical risks, including protests, regulatory changes, and trade negotiations, that could further destabilise supply chain operations. Additionally, Golden Week factory closures and customs slowdowns in China are expected to intensify congestion and drive up costs across air, sea, and rail networks.