Liner schedule reliability improves marginally in Oct, DSV asks customers to plan for more

Even as global shipping lines reported nearly $80 billion earnings for the first three quarters of 2021, schedule reliability recorded only marginal improvement in October of 0.4 percentage points to 34.4 percent, maintaining the range of 34 percent - 40 percent seen through 2021.

Even as global shipping lines reported nearly $80 billion earnings for the first three quarters of 2021, schedule reliability recorded only marginal improvement in October of 0.4 percentage points to 34.4 percent, maintaining the range of 34 percent - 40 percent seen through 2021.

The only positive, if one should call it that, is that schedule reliability is not plummeting further, according to Alan Murphy, CEO, Sea-Intelligence.

"On a year/year level, schedule reliability in October 2021 was down 18 percentage points. The average delay for late vessel arrivals also improved marginally, dropping to 7.34 days, albeit still the highest figure for this month, which has been a theme throughout 2021," an official statement said.

.jpg.jpg)

(Source: Sea-Intelligence)

Maersk continues to be most reliable

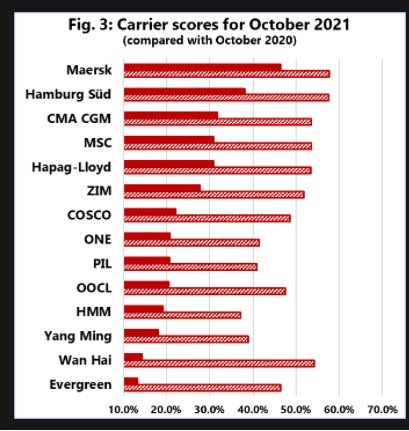

Maersk continued to be the most reliable top-14 carrier in October 2021 with schedule reliability of 46.4 percent, followed by Hamburg Süd with 38.1 percent.

Four carriers had schedule reliability of under 20 percent, with Evergreen recording the lowest October 2021 schedule reliability of just 13.4 percent.

(Source: Sea-Intelligence)

"Ten carriers recorded a month/month improvement in schedule reliability while no carrier recorded a year/year improvement with all but three carriers recording double-digit Y/Y declines of over 20 percentage points."

Carriers report $80bn operating profit in 2021. More to come?

Revenues for all carriers increased substantially as a consequence of the record-high freight rates with year/year revenue growth ranging from +83.9% for Maersk to +274.1% for Wan Hai, Sea-Intelligence added in another report.

"In terms of EBIT, the shipping lines made a whopping $37.24 billion in operating profit in 2021‑Q3 alone. Combine this with the 2021‑1H operating profit of $42.10 billion, the carriers have made nearly $80 billion in operating profit so far this year. Note that this does not include MSC, the currently second largest carrier, which is a privately held company and is not required to publish their accounts."

Put this in perspective: the combined 2010‑2020 operating profit across all quarters $37.86 billion. "In short, the industry has doubled its operating profit in three quarters of 2021 compared to the entire 2010‑2020. This is an unprecedented level of profitability."

Freight rates continue to move up

North Asia to West Coast North America freight rates, including premium service fees, were mostly higher in the $11,000-$14,000/FEU range this week while rates from North Asia to East Coast North America increased to $15,000-$18,000/FEU, S&P Global Platts said in its weekly update.

"A shipping line representative based in Europe said they were offering premium spot market rates for December sailings from North Asia at around $18,000/FEU to the US West Coast and $23,000-$27,000/FEU to the US East Coast," the report added.

Rates are likely to remain stable until the end of the month as most bookings for the Christmas season have already been made and factory production has also been reduced amid ongoing power rationing in China. "However, demand is expected to pick up in the coming month as retailers often rush their cargoes before the Chinese New Year holidays in February."

Plan ahead, plan for more: DSV to customers

DSV, the Danish transport and logistics company, is expecting exceptional demand for transportation of goods in a market characterised by limited capacity.

"On any given year, the Chinese New Year impacts the capacity to and from China and the Far East in general. The usual consequences of this include long transit times, flight cancellations and blank sailing, which have a significant impact on the global freight market for weeks after the Chinese New Year. However, this year, several extraordinary factors cause a great deal of uncertainty about what the impact of the upcoming Chinese New Year will be, DSV said in an update recently.

So, DSV is asking customers "to consider creating a forecast for a longer period of time. In this forecast, it is important to not only make a plan for the time before the Chinese New Year but also for the time that comes after the celebration as the repercussions of the Chinese New Year might be felt well into the spring. For this reason, you might also benefit from considering a deeper inventory than normal to support an easier end user delivery in your supply chain in the time after the Chinese New Year."

DSV added that businesses without strategic relationships with suppliers are likely to face additional challenges with orders ahead of the Chinese New Year. "We therefore recommend investing additional time and resources in your suppliers throughout the year and work towards confirming a diversified supplier pool if you have not already done so."

Jyothi Shankaran

Associate Editor, STAT Media Group. He has worked with IndiaSpend, Bloomberg TV, Business Standard and Indian Express Group. Jyothi can be reached at jyothi@statmediagroup.com