GS1 facilitates retail industry forum to address supply chain glitches

October 7, 2020: The global supply chain standards organisation GS1 India facilitated the ‘National Industry Forum for Retail’ (NIFR), a congregation of industry leaders, including Metro Cash & Carry, Future Group, Walmart India, Reliance Retail, Amazon, Google, BigBasket, More Retail, Flipkart, HUL, P&G, J&J, Godrej Consumer Products and ITC.

October 7, 2020: The global supply chain standards organisation GS1 India facilitated the ‘National Industry Forum for Retail’ (NIFR), a congregation of industry leaders, including Metro Cash & Carry, Future Group, Walmart India, Reliance Retail, Amazon, Google, BigBasket, More Retail, Flipkart, HUL, P&G, J&J, Godrej Consumer Products and ITC.

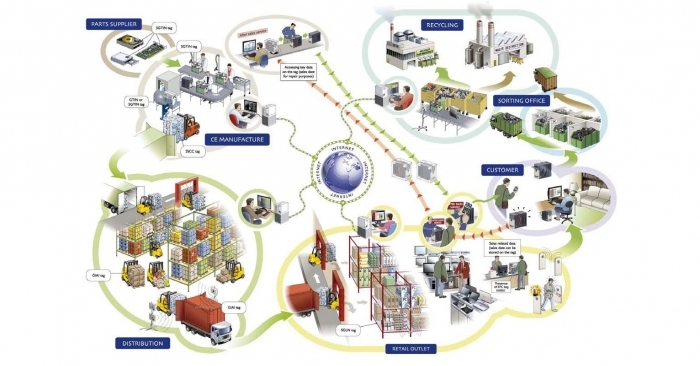

The forum is aimed at addressing challenges faced by brand owners, retailers and e-tailers in their supply & demand chain processes, enhancing operational efficiencies, and consumer trust by ensuring availability of the right product and seamless consumer experience.

One version of truth in supply chain

Swaminathan, COO, GS1 India said, “GS1 India is facilitating the NIFR collaboration between industry leaders and helping organisations in resolving common supply chain issues by making the system coherent through adoption of global best practices and standards. Together, we vision the one version of truth for product information, to drive seamless, omni channel consumer experience.”

In a digitised era, it is critical to have uniform and consistent information in the offline and online worlds. This helps manufacturers / brand owners to increase search visibility, bridge data silos and connect with consumers as well as be able to sell more products. On the other hand, the consumers are benefited as they can more efficiently search for, compare and share information about products, buy products and share their experiences.

The forum members are currently working under four groups focussing on ‘Best practices and standards adoption’, ‘Logistics standardisation’, ‘Enabling seamless consumer experience in Omni channel retailing’, and ‘Carton-level Barcoding’

Uniform rules

Pavel Mehta, head customer-facing supply chain and customer service, Nestle said, “National Industry Forum for Retail is the only congregation, where brand owners, retailers and e-tailers deliberate to address common issues faced by all of us and meet growing consumer expectations. This plays a critical role in bringing alignment among different organisations and share their best supply chain practices to bring in more efficiency and cost optimisation, especially in the new normal.”

Praveen Posina, head of content, BigBasket, said, “National Industry Forum for Retail (NIFR) has brought together industry stakeholders to develop uniform rules on several key alignments, including product code validation, product descriptions and images, that take us a step closer in providing seamless omnichannel experience to consumers.”

The forum takes up issues that can be solved through collaboration between brand owners and retailers/e-tailers to bring harmonisation in both the systems and thus ensures seamless consumer experience.

Efficient supply chain

Avinash Dhagat, general manager - supply chain, L’Oréal India said, “National Industry Forum for Retail provides a platform for brands and retailers to collaborate for meeting growing consumer expectations. Not only does it establishes coordination but as well enables the stakeholders to identify opportunities to manage the supply chains more efficiently”.

Rajat Wahi, partner, Deloitte Consulting, said, “The Covid-19 pandemic has impacted the growth of retail, which was expected to grow from $850-900 billion to $1.2 trillion by 2022, and this will now likely get pushed back to 2023-24 due to the slowdown in offline retail. The new normal has seen 80-90 percent of business for FMCG companies reaching the pre-Covid levels but with limited assortments. The current times are paving the way for new collaboration /relationships, brands are working on new opportunities with a collaborative approach in order to succeed in the retail and redefine the way they reach end consumers.”