Global air cargo volume dropped 17% YoY in Aug: Clive Data

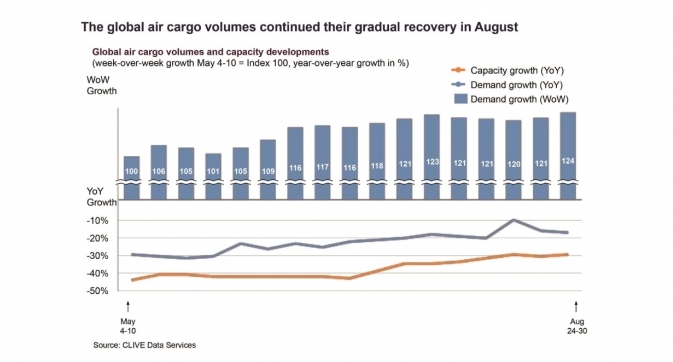

September 3, 2020: In the month of August 2020, global air cargo volumes were down 17 percent against the same month last year and compared to a 41 percent drop in April, since when month-on-month demand has improved, according to CLIVE Data Services.

September 3, 2020: In the month of August 2020, global air cargo volumes were down 17 percent against the same month last year and compared to a 41 percent drop in April, since when month-on-month demand has improved, according to CLIVE Data Services.

While according to TAC Index market intelligence, with capacity ex-China 19 percent less than in August 2019, air cargo yields on this lane remained at an elevated level; 25 percent higher than a year ago (CN/HK->EUR) and about 35 percent in the same period on the transpacific (CN/HK->US). The general pricing difference between the two compared trade routes more than doubled YOY.

CLIVE’s dynamic loadfactor

Capacity gains, however, have added to the downward pressure on both CLIVE’s ‘dynamic loadfactor’ and average yields. In August, the receding gap in the year-over-year decline between capacity and demand resulted in a global dynamic loadfactor drop from 70 percent in July to 68 percent last month, but this is still exceptionally high considering that August is traditionally air cargo’s ‘slack season’ – registering at 8 percent points higher than the corresponding performance in August 2019.

Data for the Atlantic trade lane reflected the pressure on the dynamic loadfactor - based on both the volume and weight perspectives of cargo flown and capacity available - of additional capacity entering the market. The westbound loadfactor remained strongest but dropped from 88 percent in early July to 82 percent by the end of August. Eastbound loadfactor over the same period reduced from 72 percent to 65 percent, but, because of the reduction of capacity relative to last year, these figures are still 20 percent points higher than in 2019.

Niall van de Wouw, managing director, said, “Looking at traffic flows from China, CLIVE Data Services’ analyses for August confirms that previous concerns of hardly any demand for capacity once the PPE peak subsided have not materialised. Volumes in the last week of August were ‘just’ 4 percent less than for this same week in 2019, “not great, but by no means a disaster.”

The declining #dynamicloadfactor on the North America to Europe tradelane caused airlines to pause their expansion plans. Capacity in the week of Aug 17 -23 was 3% less, than the preceding week. Thereby pushing the dynamic loadfactor upwards again by 3% points to 65%. #aircargo pic.twitter.com/eIN37nXV7k

— TIACA (@tiacaorg) August 27, 2020

Cargo, not passengers, main revenue source for airlines

He added: “Our August data shows the year-over-year decline in volumes is decreasing. The capacity crunch is still there but is becoming slightly less and, as a result, loadfactors and yields are going down and becoming closer to pre-COVID levels, even though they are still elevated. Airline cargo departments have never been in control of their own destiny, and they’re still not, but they are in control of the present and short-term in deciding where to place their cargo capacity. Whereas cargo has often been regarded as the ‘freeloader’ of the airline industry because it has always been a by-product of far greater passenger revenues, right now it is passengers who are the ‘freeloaders’ because cargo is the main source of revenue for many airlines and helping to get passenger flights back into the air.

“The massive uncertainty is when will passenger demand return and reverse the tables? The huge idle fleet of passenger aircraft needs to start flying again but no one is expecting that to happen soon in terms of great quantities of capacity. In the meantime, air cargo will continue to have its day in the sun and combination carriers will have to hope this can sustain their slimmed-down operations until passenger confidence and bookings return.”

Price fluctuations in August

In August, the price decline over July 2020 was 5 percent on Transpacific lanes and 2.5 percent on routes from HK/CN to EU. The weekly fluctuations become visible when looking at a more detailed level; for example, PVG-AMS in the period June 29-August 31 show prices increased by 22 percent, peaking on August 3 at 10 percent higher than on the last day of the month.

The latest capacity and loadfactor developments are clearly reflected in the still elevated but declining yields across the Atlantic, whereby eastbound yields have taken the greatest hit. The timeliness and the accuracy of the August data is a true reflection of market performance, TAC Index says, noting that differences within the same month can be quite substantial (up to 25 percent in some cases). Consequently, relying only on monthly averages can be misleading or risk growth opportunities being missed.

Robert Frei, business development director at TAC Index, said: “When looking at the general pricing trends, we see the reaction to supply and demand happening more swiftly. This obviously has also to do with most carriers and forwarders breaking their contracts during the crisis and the fact that procurement is now done on a shorter-term basis. With shippers also finding forecasting even more difficult during the present conditions, this situation may continue for some time. All parties are currently looking at new ways of negotiating contracts, possibly using Index Linked Agreements (ILA) or new risk management tools outside of the physical market. Such instruments are well-known and successfully practiced in other industries but are new to the air cargo market. Air freight has for many carriers and forwarders been the main source of revenue over the last couple of months, which also shows in their results. The importance of air cargo to the recovery of global trade has become very visible and recognized.”