Global air cargo capacity in August down 29.4% YoY; demand down 12.6%

September 30, 2020: The International Air Transport Association (IATA) released its analysis for global air freight markets in August with demand measured in cargo tonne-kilometres (CTKs) down 12.6 percent year-on-year, compared to 14.4 percent in July and capacity shrank by 29.4 percent compared to the previous year.

September 30, 2020: The International Air Transport Association (IATA) released its analysis for global air freight markets in August with demand measured in cargo tonne-kilometres (CTKs) down 12.6 percent year-on-year, compared to 14.4 percent in July and capacity shrank by 29.4 percent compared to the previous year.

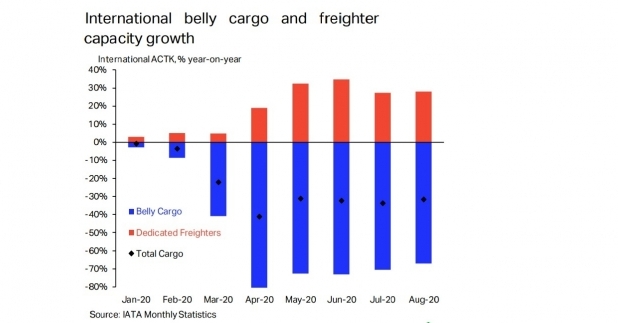

Belly capacity for international air cargo was 67 percent below the levels of August 2019 owing to the withdrawal of passenger services amid the Covid-19 pandemic. This was partially offset by a 28.1 percent increase in dedicated freighter capacity. Daily widebody freighter utilization is close to 11 hours per day, the highest levels since these figures have been tracked in 2012.

“Timely indicators of economic activity – such as manufacturing new export orders – have displayed robust signs of recovery in recent months, despite elevated global new cases of Covid-19. The rebound in cargo volumes has been slower than expected based on those metrics. This is mostly because air cargo capacity remains insufficient, with industry-wide available cargo tonne-kilometres (ACTKs) declining by 29.4 percent in August. International belly capacity is still scarce, and airlines have not been able to raise dedicated freighters capacity as much as needed. Air transport has also lost the market share of global trade due to competition from cheaper ocean trade, a typical pattern during downturns but not what is usually experienced at the start of an economic upturn,” said the analysis.

Alexandre de Juniac, director general and CEO, IATA, said, “Air cargo demand improved by 1.8 percent in August compared to July. That’s still down 12.6 percent on previous year levels and well below the 5.1 percent improvement in the manufacturing PMI. Improvement is being stalled by capacity constraints as large parts of the passenger fleet, which normally carries 50 percent of all cargo, remain grounded. The peak season for air cargo will start in the coming weeks, but with severe capacity constraints, shippers may look to alternatives such as ocean and rail to keep the global economy moving.

Asia-Pacific airlines saw demand for international air cargo fall 18.3 percent in August 2020 compared to the same period a year earlier. After a robust initial recovery in May, month-on-month growth in seasonally-adjusted demand declined for the second consecutive month. International capacity is particularly constrained in the region, down 35 percent.