Deutsche Post DHL Group revenue up 2.9% to EUR 63.3 billion in 2019

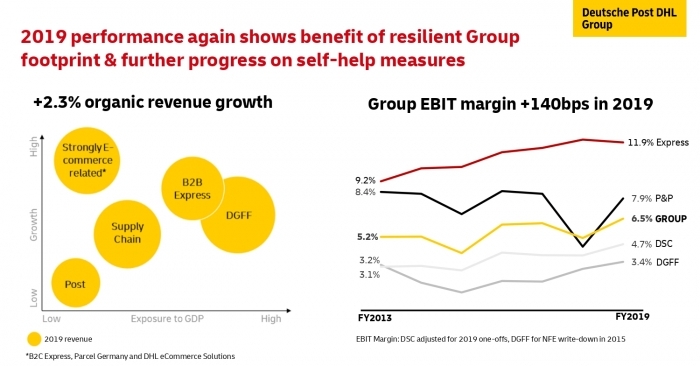

March 12, 2020: The international logistics company, Deutsche Post DHL Group posted a profitable growth during the past financial year of 2019. Group revenue was up 2.9% year on year to EUR 63.3 billion, with all five divisions contributing to this positive performance.

March 12, 2020: The international logistics company, Deutsche Post DHL Group posted a profitable growth during the past financial year of 2019. Group revenue was up 2.9% year on year to EUR 63.3 billion, with all five divisions contributing to this positive performance.

Operating profit (EBIT) improved by 30.6% to EUR 4.1 billion - a new record. With this Deutsche Post DHL Group clearly achieved its 2019 EBIT guidance of EUR 4.0 to 4.3 billion targeted for 2019. The Post & Parcel Germany division contributed EUR 1.2 billion to earnings (forecast: EUR 1.1 to 1.3 billion). The DHL divisions generated total EBIT of EUR 3.4 billion (forecast: EUR 3.4 to 3.5 billion). The Group is feeling the effects of the coronavirus on current business performance.

Therefore, the annual targets for 2020 are now excluding the potential effects of the coronavirus.

"Thanks to our broad geographic set-up and our comprehensive portfolio we are in a very robust position and more resilient than other companies in our sector. We succeeded in growing further in all areas and generating record earnings despite the challenging global economic environment in 2019. Of course, we cannot disconnect completely from the global economy. We will not remain entirely unaffected by this worldwide crisis. However, it is currently much too early to judge its financial impact," explained Frank Appel, CEO of Deutsche Post DHL Group. "In spite of this, we are forging ahead with our Strategy 2025 and putting the company on track to continue our profitable growth in 2020 and beyond."

EBIT forecast for 2020 conditional; financial guidance for 2022 confirmed

The business development in Post & Parcel Germany as well as in DHL Supply Chain and DHL eCommerce Solutions has only been marginally impacted by the coronavirus crisis. In contrast, the Group currently sees more significant effects for the Global Forwarding and Express divisions. For this reason, the company has excluded an as of now unquantifiable effect of the impact of the coronavirus from the 2020 Group EBIT guidance of more than EUR 5 billion. Deutsche Post DHL Group additionally anticipates expenses of between EUR 300 and 400 million for the decision regarding StreetScooter taken in February.

The Group has confirmed the medium-term projections of earnings and capital expenditure (capex) announced along with Strategy 2025 in October. The guidance for 2022 calls for an increase in Group EBIT to at least EUR 5.3 billion. Capex for the period from 2020 to 2022 is expected to total cumulative EUR 8.5 to 9.5 billion. The Group increased its cash flow forecast: For the period from 2020 to 2022, the Group is projecting cumulative free cash flow of EUR 5.0 to 6.0 billion (previously: EUR 4.5 to 5.5 billion). To achieve these targets, the Group plans to push growth in its profitable core businesses and to accelerate the digital transformation in all divisions as stated in its Strategy 2025.

Dividend: Increase to EUR 1.25 per share proposed

The encouraging increase in revenue and earnings in the past financial year is reflected in higher net profit for the year. Consolidated net profit for the period after non-controlling interests was EUR 2.6 billion (2018: EUR 2.1 billion). Basic earnings per share registered a corresponding increase from EUR 1.69 in 2018 to EUR 2.13 in 2019. The fact that the rise in net profit did not match the increase in EBIT was due primarily to a higher tax rate of 20.1% for 2019 after a rate of 14.0% for 2018 (due to special factors). The tax rate for 2019 was within the projected range of 19% to 22%.

In light of the Group's good earnings performance, the Board of Management and the Supervisory Board plan to propose an increase in the dividend from last year's EUR 1.15 per share to EUR 1.25 per share this year to the Annual General Meeting on 13 May 2020. If approved by the shareholders, the total payout would be approximately EUR 1.5 billion, reflecting a payout ratio of 59%. This is within the range of 40% to 60% communicated in the company's finance strategy, which has been in place unchanged since its introduction in 2010.

Strong cash flow trend despite continued high investment levels

As communicated in the preliminary figures for 2019, Deutsche Post DHL Group continued to invest heavily in profitable growth also in the past financial year, spending a total of EUR 3.6 billion across all divisions - approximately EUR 1 billion more than in the prior year. This includes EUR 1.1 billion for the debt-financed renewal of the Express division's aircraft fleet. The Group also expanded its parcel infrastructure in Germany.

Despite higher capex spending, cash flow developed very well in the past financial year. Free cash flow was EUR 867 million - including the cash paid to renew the aircraft fleet - and therefore well above the figure of EUR 500 million projected for 2019 (2018: EUR 1.1 billion).

Post & Parcel Germany: a new record of 1.6 billion parcels transported

Revenue was up 2.5% in the Post & Parcel Germany division to EUR 15.5 billion in 2019. Thanks to the sustained boom in e-commerce, the German parcel business continued to perform very well. Post & Parcel Germany set a new record by transporting approximately 1.6 billion parcels in 2019, up 5.9% compared with the previous year. The holiday season also went well: for the first time the division transported more than 250 million parcels in the six weeks before Christmas.

In the Post business unit, the structural decline in mail volumes persisted during the past financial year. The decrease of 3.0% was within the projected long-term range of 2% to 3% per year. The postage rate increase that took effect on 1 July 2019 could not compensate for the resulting decrease in revenue, which was down by another 1.2% year on year to EUR 9.6 billion.

EBIT at Post & Parcel Germany was up by 80.1% to EUR 1.2 billion in the past financial year. After adjusting for one-time effects recognized in the previous year - mainly restructuring expenses - the EBIT increase came to 14.2%. The improvement demonstrates that the measures introduced to increase productivity and reduce indirect costs are taking hold. However, the positive impact of the pricing and cost initiatives implemented at Post & Parcel was counteracted by higher personnel expenses, transport costs and costs of materials.

Express: sustained growth, consistently high margins

The longstanding upward trend in revenue and earnings continued in 2019 in the Express division. Revenue was up 5.9% to EUR 17.1 billion, with the division registering growth across all regions. This dynamic performance was once again driven by the international time-definite (TDI) delivery business, where daily shipment volumes rose by 5.7% compared with the prior-year period to more than 1 million items.

The volume increase enabled the division to utilize its unique global express network even more efficiently. Operating profit grew by 4.2% to EUR 2.0 billion on the back of strict yield management and continuous improvements in the network. Foreign currency losses prevented an even greater improvement in operating profit. The operating margin remained high at 11.9%.

Global Forwarding, Freight: improvements despite the difficult market environment

In a challenging market environment, the Global Forwarding, Freight division posted a year-on-year revenue increase of 1.0% to EUR 15.1 billion. The development of the global air freight market had been weak since the second quarter of 2019, and the ocean freight and overland freight transport markets also lost momentum as the year progressed.

Global Forwarding, Freight nonetheless succeeded in markedly improving profitability thanks to the systematic implementation of measures to boost cost-efficiency. Operating profit surged by 17.9% year on year to reach EUR 521 million. The Global Forwarding, Freight division thus came another step closer to catching up to its main competitors in terms of earnings profitability.

Supply Chain: positive EBIT and margin development

The Supply Chain division increased revenue by 0.6% to EUR 13.4 billion in the past financial year despite the sale of its Chinese business to S.F. Holding in the first quarter of 2019. After adjusting for portfolio and foreign exchange effects, revenue grew by 1.5%. There were continued gains in new business: DHL Supply Chain concluded additional contracts worth EUR 1.2 billion with both new and existing customers during the financial year 2019.

Operating profit was up significantly to EUR 912 million (2018: EUR 520 million) mainly as a result of one-time effects generated from the S.F. Holding transaction, which contributed EUR 426 million to division EBIT. The Supply Chain division immediately reinvested a portion of the proceeds of the transaction in restructuring its business - mainly in the United Kingdom - with the goal of improving future profitability. After adjusting for one-time effects, Supply Chain reported an operating margin of 4.7%, which is at the upper end of the targeted range of 4 to 5%.

eCommerce Solutions: new division organically already profitable

The new DHL eCommerce Solutions division registered strong growth in its very first year of existence. Created at the beginning of the year as a carve-out from the German mail and parcel business, the division increased revenue by 5.5% to EUR 4.0 billion. All regions contributed to this improvement, with especially the United States, the Netherlands and Poland increasing revenue. The good results posted by eCommerce Solutions reflect Deutsche Post DHL Group's strong positioning in the international e-commerce sector.

As expected, the restructuring measures in the division had a negative impact on operating profit. The expenses incurred (EUR 80 million) pushed EBIT down to EUR -51 million. After adjusting for the restructuring expenses, however, the division already reported a positive operating EBIT for the past financial year. eCommerce Solutions is expected to contribute between EUR 50 and 100 million to EBIT in 2020.

Fourth quarter: strong holiday season

In the final quarter of 2019, revenue was up by 0.2% over the prior-year figure to EUR 17.0 billion. Whereas the Post & Parcel Germany, Express and eCommerce Solutions divisions succeeded in increasing revenue, Global Forwarding, Freight felt the effects of the weak market and Supply Chain was negatively impacted mainly by the sale of the division's Chinese business on a year on year basis. The Group increased operating profit by 10.9% to EUR 1.3 billion in the fourth quarter, largely thanks to the strong holiday season. Adjusted for one-time effects, EBIT rose by 6.7%. Consolidated net profit for the period after non-controlling interests improved by 5.5% to EUR 858 million. Basic earnings per share registered a corresponding increase from EUR 0.66 to EUR 0.70.