Five trends to shape next decade of breakbulk, container shipping

The global shipping and logistics industry is standing on the edge of a radical transition, with both charter vessel and breakbulk shipping looking to increasingly take a dominant position in the next decade. This shift is largely driven by various factors such as increasing container rates; trade dynamics; concerns about monopolies in the container shipping market, and smaller new entrants into the charter market. This article looks at the trends and predictions that will shape the future of freight over the next decade.

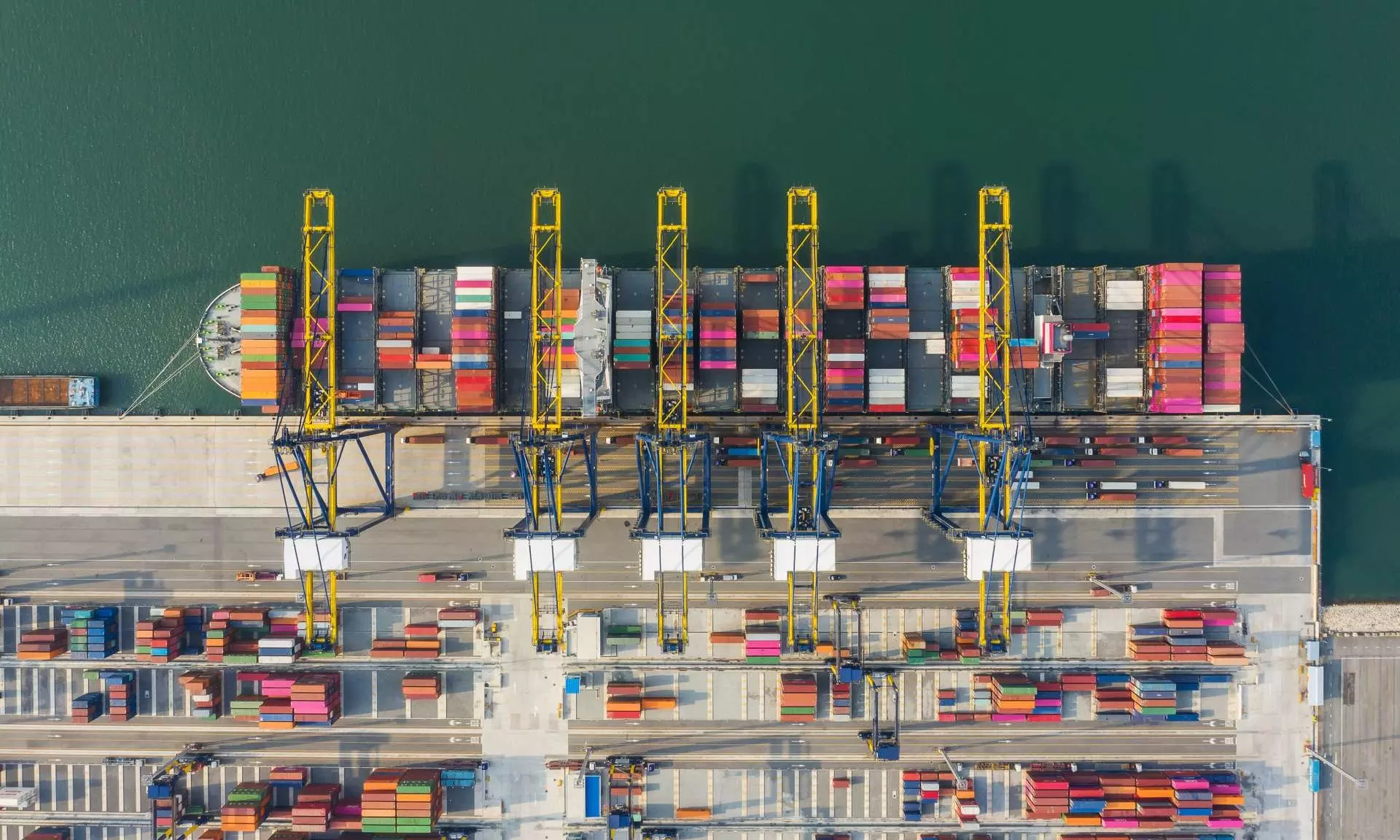

Rise of breakbulk shipping and container shipping

Professionals dealing in the shipping industry are increasingly selecting charter vessels for great flexibility and control. Chartering a vessel allows the supplier to secure a fixed vessel capacity for a particular route and dates, reducing the constraints of the liner services and also bypassing the risk of rolled cargo.

Container shipping is one of the leading modes of transport for manufacturing goods, it has also experienced variability that has been unmatched in recent years. Charter rates have also been less volatile than the container rates which offers the shippers greater predictability about their transportation costs. This is majorly appealing for businesses that specialise in cargo or those that are operating in niche markets.

The transportation of non-containerized cargo, or breakbulk shipping, is likewise experiencing a sharp upsurge. This kind of transportation is best suited for project cargo, heavy-lifting goods, and commodities that are difficult to containerize. The need for breakbulk shipping is growing as a result of the surge of renewable energy projects, infrastructure development, and industrial expansion. These projects require specialized vessels and handling equipment.

1. Technological disruption

It is clear that technology has significantly changed freight dynamics. The emergence of digital platforms for matching shippers with available vessels would make it easier, faster and cheaper to charter ships. Predictive analytics using big data to predict customer behaviour can ensure best business decisions are made in order to optimize operational efficiency for the highest demand fluctuations while preventing stock-outs.

2. Evolving geopolitical landscape and trade

Trade agreements and geopolitics will continue to shape global trade. So, businesses need to expand their supply chains and diversify along with exploring new markets to adapt to such legislative changes and tariffs. To reduce risk and increase responsiveness, companies may consider regionalization or nearshore more attractive than before. Besides, infrastructure projects like the China Belt and Road Initiative are building new trade routes and opportunities.

3. Collaboration and customer focus

Industry players will increasingly have to work together. More and more companies will turn to partnerships and alliances,-tapping into complementary strengths, and gaining reach with an eye on the respective benefit. The freight companies will have to work out more tailored solutions in direct response to the enhanced customer demand for personalization and flexibility.

4. Change in government regulations

When it comes to safety and environmental requirements, the government seems to be getting more involved in the freight industry. And, to ensure that everyone is starting from the same point, which highlights a dynamic and exciting future for freight transportation. Businesses that have fully accepted these changes and have modified their approach have been in a better position to capitalize on the tsunami of change that will define the upcoming years.

5. Regulatory landscape and trade dynamics

Geopolitical developments and regulatory changes will have a long-term impact on global trade patterns and freight operations. Trade agreements, tariffs, and other geopolitical tensions have a high chance of affecting logistical choices and supply chain tactics. Businesses need to continuously navigate dynamic regulatory environments to ensure compliance, modify risk-reduction tactics, and take advantage of opportunities presented by emerging markets.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Indian Transport & Logistics News.