Blank sailings plateauing, spot rates maintain strength: Sea-Intelligence

May 19, 2020: Sea-Intelligence in its week’s issue discussed the plateauing of new blank sailings announcements, the slump in container volumes in North America East Coast ports in 2020-Q1, and the strength of the freight rates.

May 19, 2020: Sea-Intelligence in its week’s issue discussed the plateauing of new blank sailings announcements, the slump in container volumes in North America East Coast ports in 2020-Q1, and the strength of the freight rates.

While the total number of announced blank sailings have now crossed the 500-mark, there has only been an increase of 7 over the past week. We have now reached a plateau where carriers are maintaining their existing blank sailings, without the need for a large-scale increase in new blank sailings announcements.

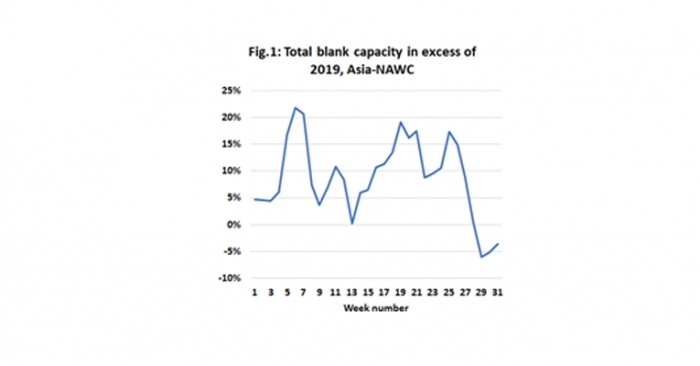

That said, absent a pandemic, carriers would still have blanked some sailings to manage seasonal demand fluctuations. To give some perspective on where we are in relation to a “normal” 2020, figures 1 and 2 show the blank sailings in excess of 2019 for Asia-North America West Coast and Asia-North Europe. We can see a short period culminating in week 13 where there were no new blank sailings compared to 2019, a period between the Chinese New Year plus Coronavirus induced blank sailings, and the spread of the virus into a global pandemic. This is a trend that we see across all major East/West trade lanes. Going into Q3, blanked capacity seems to taper off, indicating a return to the “normal” levels of blank sailings. That said, carriers normally only announce blank sailings 4-6 weeks prior to departure, and this could be just that.

We also find that carriers have been particularly good at maintaining freight rates, and net of fuel, spot rates are actually up 25-40 percent in some trades compared to 2019. Carriers achieved this through rapid and hard capacity cuts, as we have been covering in depth for the past several weeks.