Global air cargo revenues to be $142 billion in 2023: IATA

Yields will be negatively impacted by two factors: (1) increased available belly capacity for cargo and (2) the negative effects of economic cooling measures introduced to fight inflation.

The International Air Transport Association (IATA) announced an expected strengthening of airline industry profitability in an upgrade of its outlook for 2023 while cargo revenues are expected to be $142.3 billion.

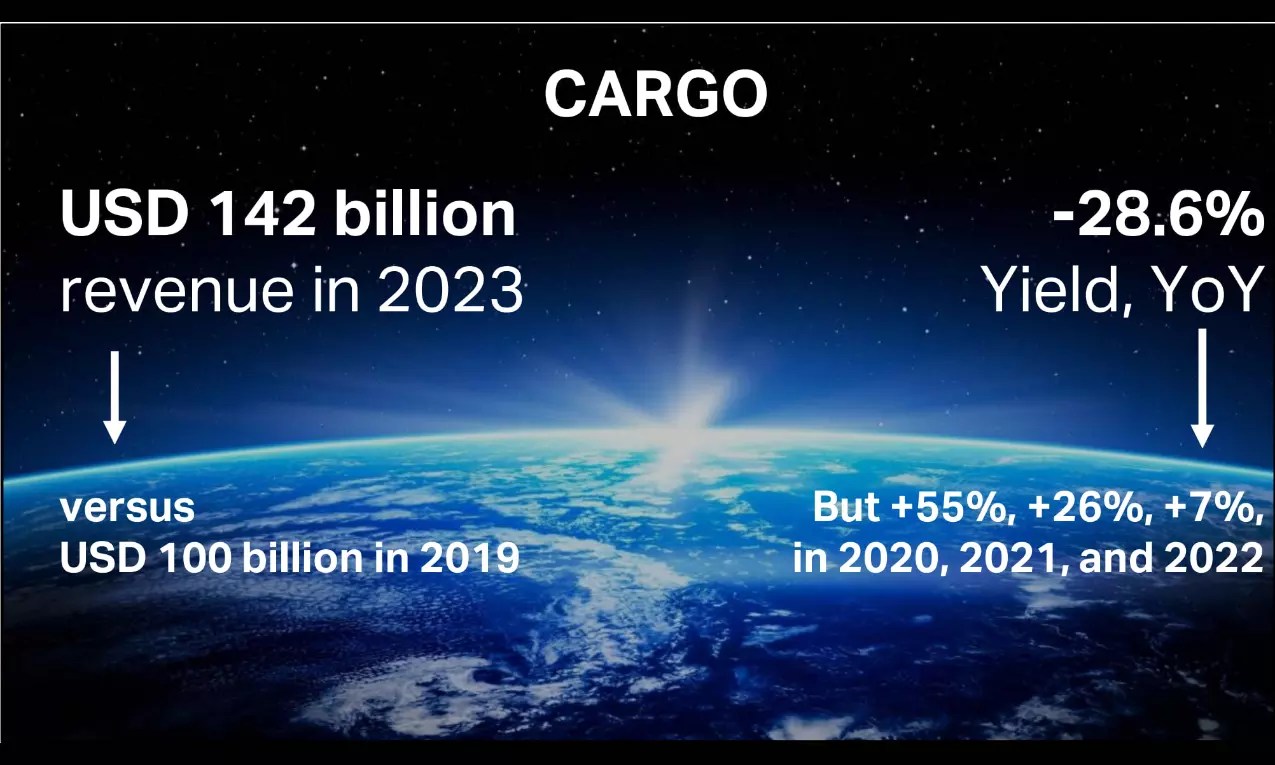

While that is down sharply from $210 billion in 2021 and $207 billion in 2022, it is well above the $100 billion earned in 2019.

Cargo volumes are expected to be 57.8 million tonnes, which has slipped below the 61.5 million tonnes carried in 2019 with a sharp slowing of international trade volumes.

“Yields will be negatively impacted by two factors: (1) the ramping-up of passenger capacity which automatically increases available belly capacity for cargo and (2) the potential negative effects on international trade of economic cooling measures introduced to fight inflation. Yields are expected to correct with a 28.6 percent decline this year, but still remain high by all historical comparisons. Note that yield increases of 54.7 percent were recorded in 2020, 25.9 percent in 2021 and 7.4 percent in 2022,” it reads.

Airline industry net profits are expected to reach $9.8 billion in 2023 (1.2 percent net profit margin) which is more than double the previous forecast of $4.7 billion (December 2022).

Airline industry operating profits are expected to reach $22.4 billion in 2023, much improved over the December forecast of a $3.2 billion operating profit. It is also more than double the $10.1 billion operating profit estimated for 2022.

Total revenues are expected to grow 9.7 percent year over year to $803 billion. This is the first time that industry revenues will top the $800 billion mark since 2019 ($838 billion). Expense growth is expected to be contained to an 8.1 percent annual increase.

“Airline financial performance in 2023 is beating expectations. Stronger profitability is supported by several positive developments. China lifted COVID-19 restrictions earlier in the year than anticipated. Cargo revenues remain above pre-pandemic levels even though volumes have not. And, on the cost side, there is some relief. Jet fuel prices, although still high, have moderated over the first half of the year,” said Willie Walsh, IATA’s Director General.

The return to net profitability, even with a 1.2 percent net profit margin, is a major achievement. First, it was achieved at a time of significant economic uncertainties. And second, it follows the deepest losses in aviation’s history ($183.3 billion of net losses for 2020-2022 (inclusive) for an average net profit margin of -11.3 percent over that period). It should be noted that the airline industry entered the COVID-19 crisis at the end of a historic profit streak that saw an average net profit margin of 4.2 percent for the 2015-2019 period.

“Economic uncertainties have not dampened the desire to travel, even as ticket prices absorbed elevated fuel costs. After deep COVID-19 losses, even a net profit margin of 1.2 percent is something to celebrate! But with airlines just making $2.25 per passenger on average, repairing damaged balance sheets and providing investors with sustainable returns on their capital will continue to be a challenge for many airlines,” said Walsh.

Revenues are rising (9.7 percent) faster than expenses (8.1 percent), strengthening profitability.

Revenue: Industry revenues are expected to reach $803 billion in 2023 (+9.7 percent on 2022 and -4.1 percent on 2019). An inventory of 34.4 million flights is expected to be available in 2023 (+24.4 percent on 2022, -11.5 percent on 2019).

Expenses are expected to grow to $781 billion (+8.1 percent on 2022 and -1.8 percent on 2019).

The economic and geopolitical environment presents several risks to the outlook. With just $22.4 billion of operating profit (2.8 percent) standing between $803 billion of revenues and $781 billion in expenses, industry profitability is fragile and could be affected (positively or negatively) by a number of factors. In particular, consideration should be given to:

Inflation fighting measures are maturing at different rates in different markets. Central banks are calibrating the best levels for interest rates to have a maximum cooling effect on inflation while avoiding tipping economies into recession. An early or lower end to rate rises could stimulate markets for a stronger year-end outlook. Equally, the risk of recession remains. Should recession lead to job losses, the industry’s outlook could shift negatively.

War in Ukraine is not having a major impact on profitability for most airlines. A currently unanticipated peace could carry the potential for cost improvements with lower oil prices and efficiencies from the removal or easing of airspace restrictions. An escalation, however, would likely have negative prospects for global aviation. Already broader geopolitical tensions are weighing upon international trade and any escalation of such tensions represents a downside risk to the industry outlook.

Supply chain issues continue to impact global trade and business. Supply chains are shifting to fill gaps in resilience caused by current geopolitical tensions and the challenges experienced during COVID-19. Airlines have been directly impacted by aircraft parts supply chain ruptures which aircraft and engine manufacturers have failed to sort out. This is negatively impacting the delivery of new aircraft and the ability of airlines to maintain and deploy existing fleets.

Regulatory cost burdens are at risk of increase from increasingly interventionist regulators. In particular, the industry could face rising costs of compliance for increasingly punitive passenger rights regimes and regional environment initiatives.