90% commercial vehicles back on road, toll collections indicate: ICRA

August 31, 2020: Post the resumption of tolling on national highways from April 20, 2020, the movement of commercial vehicles picked up significant pace over the last three months and has reached near 90 percent of pre-Covid levels, according to the credit rating agency ICRA.

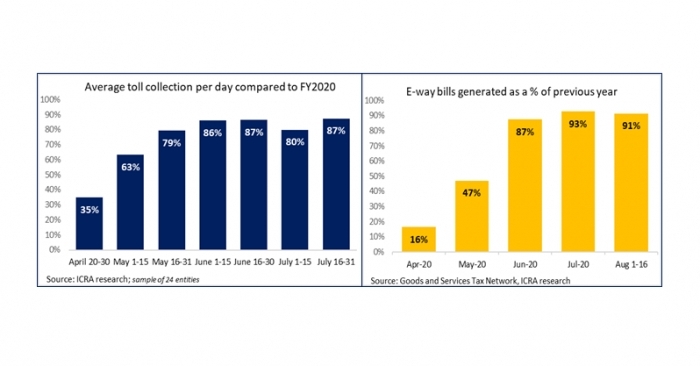

August 31, 2020: Post the resumption of tolling on national highways from April 20, 2020, the movement of commercial vehicles picked up significant pace over the last three months and has reached near 90 percent of pre-Covid levels in July, according to the credit rating agency ICRA.

However, the movement in passenger vehicles is yet to recover fully. The unabated rise in Covid-19 infections in the unlock phase, localised re-imposition of lockdowns in several states, and heavy monsoons in many parts of the country had interrupted this recovery in the first fortnight of July. Nevertheless, the toll collections reached 87 percent of pre-Covid levels in the second fortnight of July 2020.

Rajeshwar Burla, vice president, Corporate Ratings, ICRA said, “Majority of the national highway stretches being arterial routes have 70-75 percent of toll collections from commercial vehicles; passenger vehicles account for less than a quarter of toll collections. While 90 percent of commercial vehicles are back on roads, the passenger vehicle movement is less than 60 percent of pre-covid levels. Overall, the traffic in 4M FY2021 has rebounded quite well, which is encouraging. This is also corroborated by the e-way bills generated. This pace of recovery, if sustained, the overall reduction in toll collections for national highway projects could be less than 10 percent in FY2021.”

Toll collections are on the road to recovery; reached 85% of pre-covid levels in July 2020.#ICRAViews #TollCollection #IndianRoadSector #RoadsandHighways @NHAI_Official @MORTHIndia pic.twitter.com/yECLdqoBuT

— ICRA (@ICRALimited) August 27, 2020

Tamil Nadu & Maharashtra

The sample considered for the analysis is spread across 11 states with Tamil Nadu, Rajasthan, Maharashtra and Telangana accounting for 63 percent of the total sample. The localised lockdowns imposed in Tamil Nadu and Maharashtra had adversely affected the toll collections for the stretches located in these states in July 2020 (reported 65-75 percent of pre-Covid levels). Excluding these stretches, the other entities in the sample reported around 90 percent of pre-Covid collections in July 2020.

As for the impact on the ratings for ICRA rated BOT (Toll) road portfolio, In 4M FY2021, the ratings agency upgraded one issuer which had achieved COD a year ago and demonstrated significant ramp-up in toll collections. There were three rating downgrades; the rating action in two of these three issuers was on account of breach of rating triggers due to expected deterioration in coverage metrics on account of reduced toll collections. In the case of the third issuer, the rating action was on account of adverse regulatory development wherein NHAI had served termination notice – downgraded and placed on rating watch. There are two entities for which outlook have been revised to Negative.

“Around 85 percent of ICRA rated toll road projects (excluding default category credits) have debt service reserve (liquidity buffer) greater than or equal to one-quarter of a debt obligation (includes principal and interest) and are resilient enough to absorb the Covid-19 induced revenue shock,” Burla added.